pay indiana state sales taxes

File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident. Take the renters deduction.

For the feds youll need to register with the IRS.

. Ad Find Recommended Indiana Tax Accountants Fast Free on Bark. Your browser appears to have cookies disabled. Indiana levies several taxes and fees in addition to its sales tax of 7 percent including a complimentary use tax.

3 2022 or earlier. Find Indiana tax forms. File my taxes as an Indiana resident while I am in the military but my spouse is not an Indiana resident.

This registration allows you to legally conduct retail sales in the state of Indiana. You are eligible for the initial 125 Automatic Taxpayer Refund if you filed an Indiana resident tax return for the 2020 tax year with a postmark date of Jan. The Department of Revenue now declares that there is no tax obligation on shipping charges as long as they are stated separately on the invoice.

Although trade or dealer discounts are taken off from the sales price any manufacturer discounts are not deducted from the sales price for tax purposes. 2022 Current Resources- Indiana State Sales Tax. Whether youre a large multinational.

Find Indiana tax forms. Know when I will receive my tax refund. Both types of taxes are reported on the sales tax return.

Take the renters deduction. Indiana businesses have to pay taxes at the state and federal levels. Claim a gambling loss on my Indiana return.

Cookies are required to use this site. Pay my tax bill in installments. Indiana sales tax is collected at the point of purchase.

Indiana has no special sales tax jurisdictions with local sales taxes in addition to the state sales tax. Or Completing Form ES-40 and mailing it with your payment. Ad Indiana State Sales Tax Same Day.

This registration can be completed in INBiz. Do not send cash. Have more time to file my taxes and I think I will owe the Department.

You may also pay using the electronic eCheck payment methodThis service uses a paperless check and may be used to pay the taxdue with your Indiana individual income tax return as well as anybillings issued by the Indiana Department of Revenue for any tax typeTo pay go to wwwingovdoronline-servicesdorpay-tax-and-billpaymentand. The Indiana state sales tax rate is 7 and the average IN sales tax after local surtaxes is 7. Using a preprinted estimated tax voucher issued by the Indiana Department of Revenue DOR for taxpayers with a history of paying estimated tax.

Filing Due Date Is August 31st. Ad Access Tax Forms. Pay my tax bill in installments.

Shipping charges in Indiana are not taxable as of July 1 2013. Businesses that sell tangible personal property need to register for a sales tax account. An Indiana resident tax return means you filed your state taxes using one of the following.

If you choose to deliver goods yourself or through a private delivery service then your shipping is taxable. All businesses wishing to become members of Streamlined Sales Tax must register at the following national registration site. The listed sales tax rate for Indiana is.

County Rates Available Online-- Indiana county resident and nonresident income tax rates are available via Department Notice 1. Groceries and prescription drugs are exempt from the Indiana sales tax. After your business is registered in Indiana you will begin paying state and local income taxes on any profits earned in Indiana and sales tax on any tangible property sold or shipped from the state.

Counties and cities are not allowed to collect local sales taxes. Indiana Full-Year Resident Individual Income Tax Return. Corporations must pay the Indiana Corporate Income.

More information is available in the Electronic Payment Guide. The state charges a 7 sales tax on the total car price at the moment of registration. INBiz can help you manage business tax obligations for Indiana retail sales withholding out-of-state sales gasoline use taxes and metered pump sales.

Claim a gambling loss on my Indiana return. But for the Department of Revenue you can do it here. Ad File the Online Form 2290 For Vehicles Weighing 55000 Pounds or More.

Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. When you buy a car you have to pay Indiana sales tax on the purchase plus excise tax to register the vehicle. An INTIME Functionality chart listed by tax type is available.

Any business meeting these qualifications must register with the Department of Revenue. Once your registration is completed and processed youll be issued a Registered Retail Merchant Certificate RRMC. If you have Indiana specific Streamlined Sales Tax questions contact Indiana Department of Revenue DOR by email or call us at 317-615-2900.

Have more time to file my taxes and I think I will owe the Department. If you sell physical products or certain types of services you may need to collect retail sales tax and then pay it to the Indiana State Department of Revenue. Know when I will receive my tax refund.

Purchasers do not pay both sales and use taxes but one or the other. 100s of Top Rated Local Professionals Waiting to Help You Today. Create a Free Account Today.

If your business sells goods or tangible personal property youll need to register to collect a seven percent sales tax. The Indiana Department of Revenues DOR e-services portal the Indiana Taxpayer Information Management Engine INTIME enables customers to manage business taxes withholding corporate income tax and individual income tax in one convenient location 247. If you work in or have business income from Indiana youll likely need to file a tax return with us.

Sales and use tax. Upon receipt of a national registration DOR will send instructions if any for the business to register. The Indiana Department of Revenue DOR offers multiple options to securely remit taxes electronically using DORs e-services portal INTIME and via Electronic Funds Transfer EFT.

ATTENTION-- ALL businesses in Indiana must file and pay their sales and withholding taxes electronically. Complete Edit or Print Tax Forms Instantly. Is Your IRS Form 2290 Due.

When Did Your State Adopt Its Sales Tax Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

How To Register For A Sales Tax Permit Taxjar

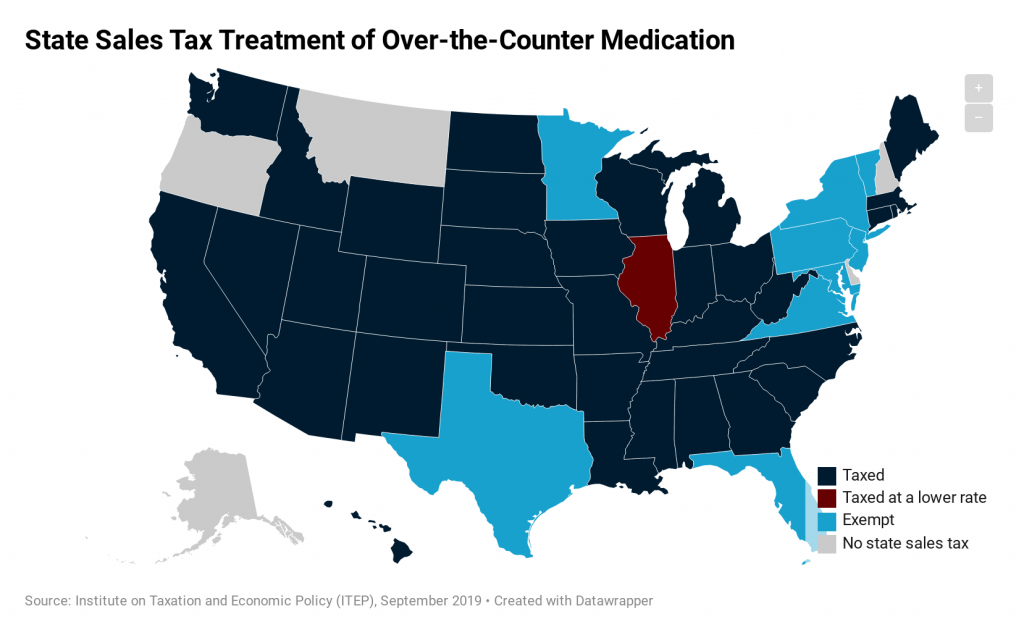

How Do State Tax Sales Of Over The Counter Medication Itep

2022 Sales Tax Rates State Local Sales Tax By State Tax Foundation

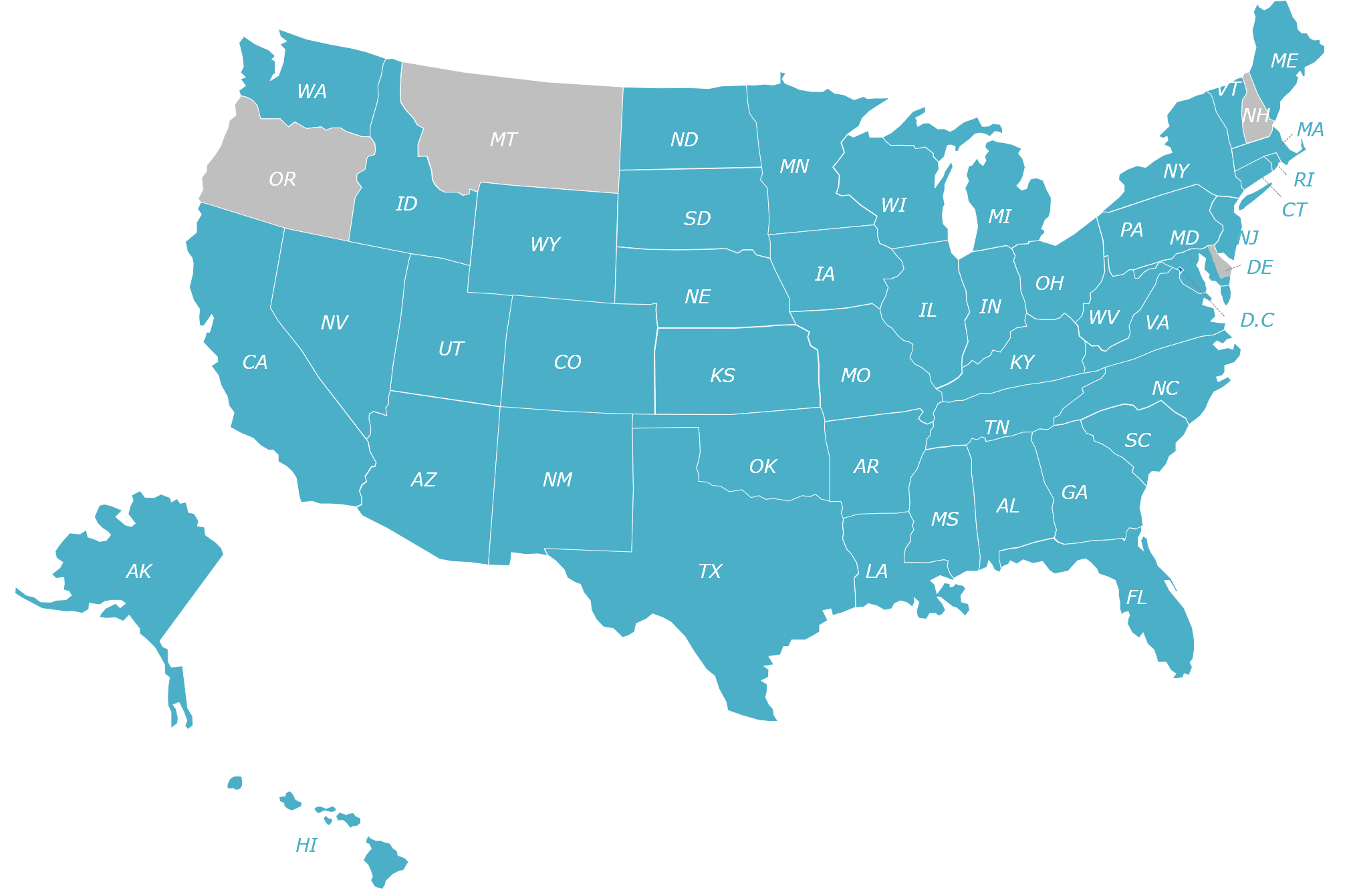

States Without Sales Tax Article

Nomad States The Latest On Sales Tax

Updated State And Local Option Sales Tax Tax Foundation

How Do State And Local Sales Taxes Work Tax Policy Center

Sales Tax By State Is Saas Taxable Taxjar

U S Sales Taxes By State 2020 U S Tax Vatglobal

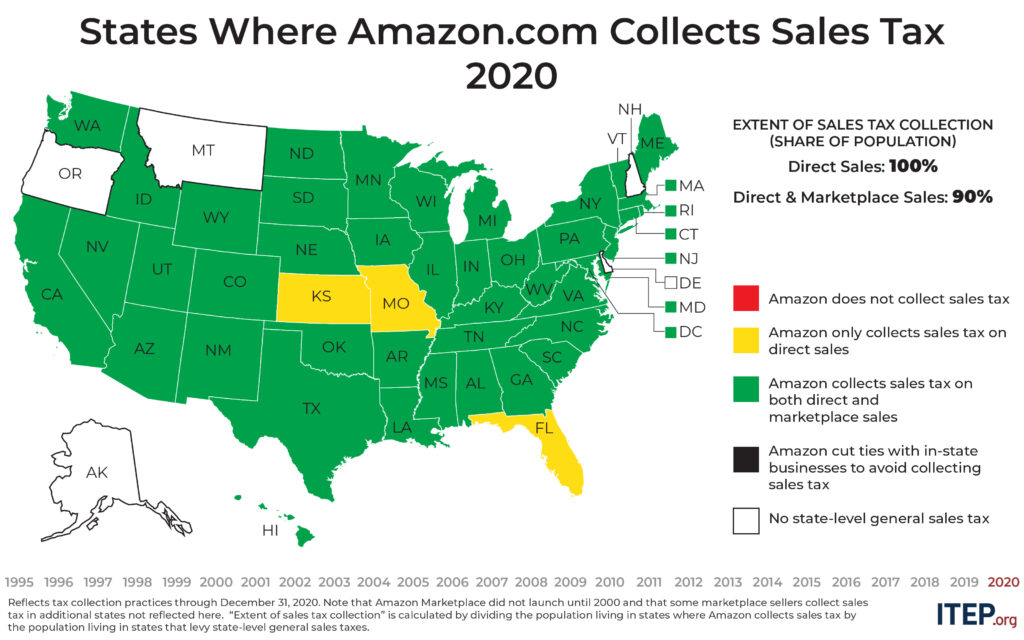

A Visual History Of Sales Tax Collection At Amazon Com Itep

Internet Sales Taxes Tax Foundation

.png)

States Sales Taxes On Software Tax Foundation

Helpful Sales Tax Steps For Amazon Fba Sellers Amazon Fba Business Sales Tax Tax Return

Recently Amazon Com Announced That It Would Begin Collecting Sales Tax For Sales In Some States Today From The Vault Money Smart Week Smart Money State Tax

A Visual History Of Sales Tax Collection At Amazon Com Itep

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)